Liberty Mutual

INSURANCE

Liberty Mutual

COMMERCIAL. INSURANCE. SOLUTIONS

LIBERTY MUTUAL GROUP

IN TIMES OF CRISIS, WE’RE HERE FOR YOU

CARGO INSURANCE

CARGO INSURANCE

Cargo insurance in Europe, Asia, Middle East, Africa are considered a vital part of any business that regularly ships goods using couriers or transport companies.

Any transport or courier company must carry a minimum amount of carrier liability coverage to be able to legally operate In Europe, Asia, Middle East, Africa. However, this kind of insurance typically offers very limited protection, not covering businesses for a wide range of real concerns. With cargo theft costing up to $5 billion per year, and $500,000 in cargo theft occurring per day In Europe, Asia, Middle East, Africa alone, cargo insurance can save a shipper from catastrophic financial consequences resulting from the loss, damage, or theft of their goods while in transit.

WHAT IS CARGO INSURANCE?

Cargo insurance is a specific type of insurance that covers goods during transit from more scenarios than is covered under a typical carrier liability policy.

Most carrier liability plans cover for very basic damage and delays, but do not cover for natural disasters, accidents, or acts of war. While they do cover for some instances of theft, the liability is capped at a level that is often drastically under the total value of the goods might have been. While these scenarios might seem outlandish, they happen more often than you might expect, and when they do happen, they can cause serious financial issues for the shipper. When the average Carrier Liability policy fails you, that’s when your Cargo Insurance In Europe, Asia, Middle East, Africa steps in.

Cargo insurance essentially covers your goods from the moment they leave their initial location until the moment they arrive at their destination. The amount of coverage including in your plan can be negotiated when you purchase your policy to ensure you are fully covered for the actual value of your goods. This can give you peace of mind knowing you won’t be left out of pocket should anything untoward happen to your goods while they are in transit.

WHY IS CARGO INSURANCE SO IMPORTANT?

Cargo Insurance In Europe, Asia, Middle East, Africa is vital in protecting a business from the potentially catastrophic loss of revenue due to lost, stolen, or damaged goods. If you have a particularly large shipment of goods you are either expecting to receive or have just sent off to the customer, a lot of your revenue is likely tied to that shipment arriving at its destination safely. Should those goods get lost, damaged, or stolen during transit, you would be on the hook for potentially hundreds of thousands of dollars of lost revenue. Toronto Cargo Insurance ensures you will be able to claim back the value of those goods and protect your business from suffering the consequences.

WHAT DOES CARGO INSURANCE COVER?

Cargo Insurance In Europe, Asia, Middle East, Africa can provide protection for any business that frequently uses the services of a courier or transport company. It can provide a range of different coverage levels, including:

-

Land Cargo Insurance: This coverage deals primarily with goods transport carried out by truck, car, or other utility vehicle. Generally, it is domestic in nature, however, it can be altered to cover international land transport as well.

-

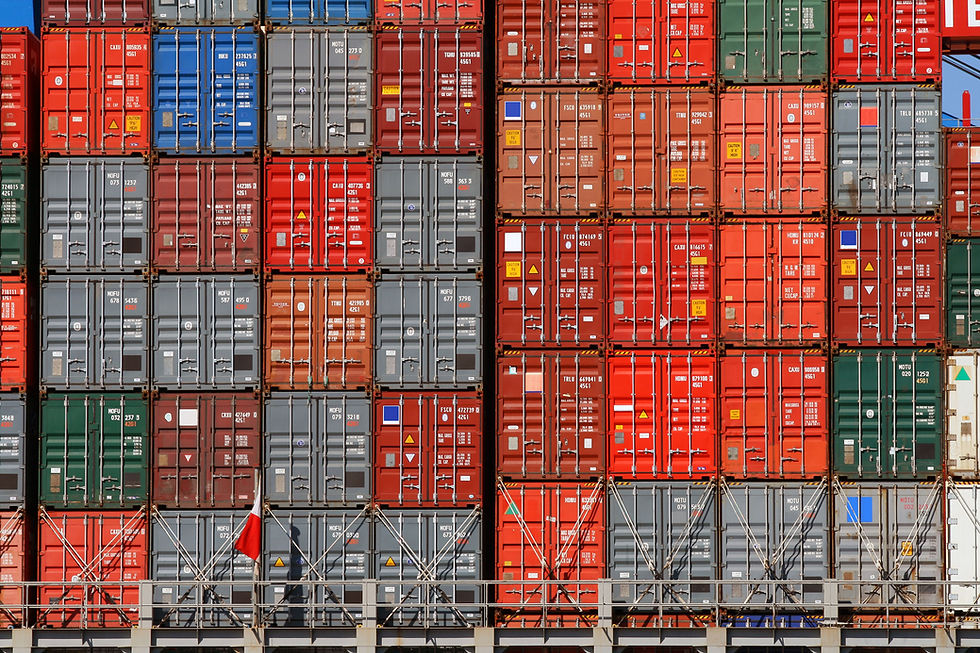

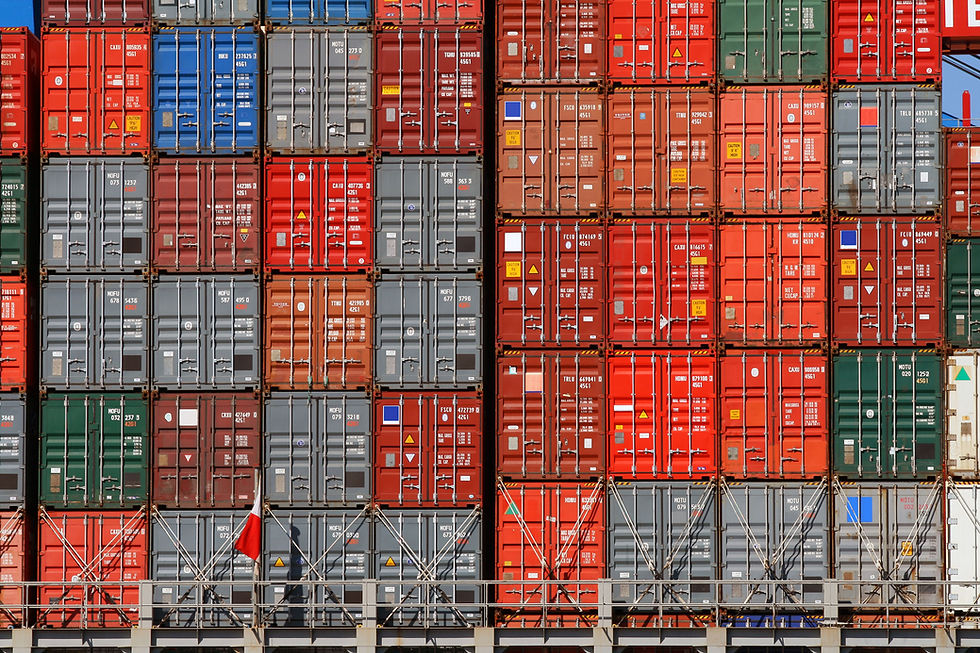

Marine Cargo Insurance: This would cover your goods while they are in transit via ship, such as in a shipping container on a freighting vessel. This will be particularly relevant for high-volume shipping companies.

-

Open Cover Cargo Insurance: This level of coverage will protect goods over multiple consignments over the course of your policy. These can either be renewable or permanent, depending on your business needs.

-

Specific Cargo Insurance: This type of coverage is ideal for a particularly high-value consignment, such as a large order fulfilment or a restocking shipment. Your goods will be covered from the time they leave until the time they arrive at their destination.

Your Cargo Insurance In Europe, Asia, Middle East, Africa can be completely customized to your business requirements. Our insurance experts at Liberty Mutual Insurance will be happy to walk you through every aspect of your policy to ensure you are covered for the things you need, and aren’t paying for the things you don’t.

WHO NEEDS CARGO INSURANCE?

Cargo Insurance can benefit a range of businesses in the transport ecosystem. Anyone who sends goods via carriers or transport companies can benefit from this insurance. So as can the carrier and transport companies themselves.

Generic carrier liability insurance only covers a very small percentage of the actual value of the goods that are being transported. Legally, carriers and transport companies are protected from having to pay out the full value of goods if they are lost, stolen, or damaged for a variety of reasons. This means that to have fully comprehensive coverage for the true value of your goods, you’ll be needing an up-to-date cargo insurance policy.

In addition, carriers and transport companies themselves may wish to have a cargo insurance policy In Europe, Asia, Middle East, Africa. While they will already have the legally required carrier liability insurance, they may choose to get an extra layer of protection to guard against possible legal action should their customer’s goods be lost or damaged in transit. This can also improve customer relations, as carriers can show their clients that their goods will be protected above and beyond the minimum legal requirements.

WHY GO WITH LIBERTY MUTUAL INSURANCE?

With the rise of ecommerce and online shopping, cargo shipments are only projected to increase over the next few decades. This presents even more opportunities for something to go wrong, making a comprehensive cargo insurance In Europe, Asia, Middle East, Africa essential. Liberty Mutual Insurance is worldwide leading specialist in creating custom cargo insurance policies that meet all the needs of our clients.

Our commitment to excellence and passion for an unparalleled client experience make us the top commercial insurance company for businesses looking to get coverage. We work with brands in many different industries and have decades of experience in negotiating detailed policies with the lowest premiums possible.